A new Elon University Poll found that support for two constitutional amendments to appear on the ballot this fall shifted when voters received additional explanation of what the amendments entail.

This fall, North Carolina voters will be asked to vote on up to six state constitutional amendments on a ballot that will contain a simple, single-sentence description of what each measure entails. Those amendments have stirred controversy, with several of the amendments tied up in court with opponents alleging that voters will be misled by the language they will find on the ballots or lacking vital information about the amendments when they cast their ballots.

The contrast between the one-sentence ballot question voters will vote “yes” or “no” on, and the longer, fuller official explanation of the substance and anticipated impact of the proposed amendments is made clear by the results of a new Elon University Poll. The online survey of more than 1,500 N.C. registered voters gauged opinions after offering the simple ballot language for two amendments, and then tracked whether the level of support for the amendments changed once voters had read the full, official explanation of the amendment.

The contrast between the one-sentence ballot question voters will vote “yes” or “no” on, and the longer, fuller official explanation of the substance and anticipated impact of the proposed amendments is made clear by the results of a new Elon University Poll. The online survey of more than 1,500 N.C. registered voters gauged opinions after offering the simple ballot language for two amendments, and then tracked whether the level of support for the amendments changed once voters had read the full, official explanation of the amendment.

The Elon Poll found that for these two amendments — one requiring a photo ID to vote and the other changing the state income tax rate cap — voters were less supportive of the two measures after they had read the more detailed explanation of the amendments, information that will not be provided to them on the ballot.

The survey found a reduction of support for both amendments once voters were offered a more complete description of the amendments written by state officials. The biggest change was seen in the income tax rate cap amendment, with support falling from 56 percent to 45 percent once voters had read the official explanation for the measure. The voter ID amendment saw a smaller reduction in support after the official explanation was presented to voters, with a drop from 63 percent to 59 percent.

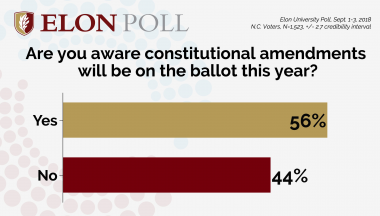

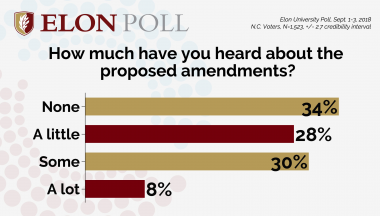

Additionally, the survey also found that voters are doing little to find out about the amendments in advance. More than half of the state’s registered voters are unaware this year’s ballot will include proposed amendments to the North Carolina constitution. About two-thirds of voters said they have heard nothing or only a little about the six proposed constitutional amendments with two months to go before the Nov. 6 general election, the poll found.

Additionally, the survey also found that voters are doing little to find out about the amendments in advance. More than half of the state’s registered voters are unaware this year’s ballot will include proposed amendments to the North Carolina constitution. About two-thirds of voters said they have heard nothing or only a little about the six proposed constitutional amendments with two months to go before the Nov. 6 general election, the poll found.

“North Carolina voters answering amendment ballot questions have the potential to make very important and extremely long-lasting changes to laws in the state,” said Jason Husser, director of the Elon University Poll and associate professor of political science. “However, a large portion of those voters are either unaware of the proposed amendments or confused by what their vote will actually enact.”

The online survey of 1,523 North Carolina registered voters was conducted Sept. 1-3, 2018. For the survey, the Elon Poll used an online opt-in sample with respondents receiving small amounts of compensation in exchange for their opinions. The survey had a credibility interval of +/- 2.7 percent. The complete survey methodology is available within the full report.

Voter ID

At the voting booth, voters will be asked to consider a “constitutional amendment to require voters to provide photo identification before voting in person,” and will be asked to vote “yes” or “no” based upon that description. The Elon Poll found that based upon that language, 63 percent of voters said they support the amendment, 20 percent said they were against it and 17 percent said they were not sure. Seventy-six percent of voters said that line alone gave them enough information to make an informed decision.

A look at demographic data found that the amendment has much stronger support among white voters (72 percent support the amendment) than among black voters (38 percent support). Additionally, Republicans and independents are more likely to support the amendment than Democrats.

For this survey, the Elon Poll provided voters with the official state explanation of the amendment as drafted by the N.C. Constitutional Amendments Publication Commission. That explanation reads:

Require Photographic Identification to Vote

This amendment requires you to show photographic identification to a poll-worker before you can vote in person. It does not apply to absentee voting.

The Legislature would make laws providing the details of acceptable and unacceptable forms of photographic identification after passage of the proposed amendment. The Legislature would be authorized to establish exceptions to the requirement to present photographic identification before voting. However, it is not required to make any exceptions.

There are no further details at this time on how voters could acquire valid photographic identification for the purposes of voting. There is no official estimate of how much this proposal would cost if it is approved.

After respondents had read the above description, 59 percent said they were for the amendment, a decline of 4 percentage points from when they were asked only the simple ballot question. Among the remainder, 25 percent said they were against it, and 16 percent said they were not sure.

The segment of those who said the official explanation gave them enough information to make an informed decision grew to 82 percent.

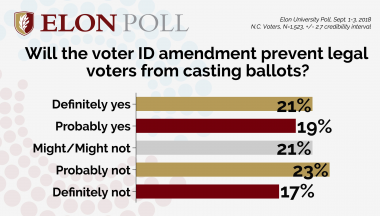

Asked about the impact that the proposed amendment could have on voting, about two-thirds said the measure would reduce voter fraud, which is offered by proponents as a rationale for the amendment. However, 40 percent of voters said that requiring voters to show a photo ID would “definitely” or “probably” prevent legal, eligible voters from casting a ballot. Another 40 percent said that “definitely” or “probably” would not be the case, and 20 percent were undecided on whether legal voters would be disenfranchised.

“Consistent with several others polls we have conducted over that last 6 years, voter id is popular among North Carolina voters,” Husser said. “Nonetheless, the sizable minority opposed to voter id tend to see it as something that will infringe on legal voters’ rights while tipping more elections toward Republican candidates.”

“Consistent with several others polls we have conducted over that last 6 years, voter id is popular among North Carolina voters,” Husser said. “Nonetheless, the sizable minority opposed to voter id tend to see it as something that will infringe on legal voters’ rights while tipping more elections toward Republican candidates.”

One of the legal challenges to the voter ID amendment as proposed is that it does not detail what would qualify as “photographic identification.” A lawsuit filed by the North Carolina NAACP contends that “without more detail, the phrase ‘photographic identification’ is essentially meaningless. For example, ‘photographic ID’ could mean something as difficult to obtain as a United States Passport, or, at the other extreme, photographic ID could mean an expired student ID or even a Costco membership card.”

Given that claim, the Elon Poll sought explore public opinion about the types of identification that should be acceptable to vote. Among the registered voters surveyed, a driver’s license or other state-issued ID was the most popular choice, with 98 percent of voters saying that ID should be acceptable. Ninety-two percent said a U.S. passport should be acceptable, while 56 percent said other non-governmental IDs such as a work ID should be. Thirty-six percent said a utility or tax bill with the voter’s residential address should be proof enough.

Looking at the history of voter ID legislation in the state and the political implications, the Elon Poll found that two-thirds of voters had heard nothing or “a little” about lawsuits that previously, and successfully, challenged the constitutionality of a voter ID law passed by the N.C. General Assembly and struck down by the courts in 2016.

As for how a voter ID constitutional amendment might play out politically, 27 percent said it would make it easier for Republicans to win elections, 6 percent said it would make it easier for Democrats, and two-thirds — 67 percent — said it would not make any difference.

Income Tax Rate Cap

The N.C. General Assembly has also approved a constitutional amendment that would reduce the current income tax rate cap from 10 percent to 7 percent. At the ballot box, voters will be asked to vote “yes” or “no” on a “constitutional amendment to reduce the income tax rate in North Carolina to a maximum allowable rate of seven percent (7%).”

Given just the language they will see on the ballot, 56 percent said they supported the amendment, 15 percent said they were against it and 30 percent said they were not sure. More than half — 56 percent — said the description gave them enough information to make an informed decision. Whites were more likely than blacks to support the measure, and Republicans were much more likely to support the amendment than Democrats.

Support for the amendment changed significantly when respondents were given the official explanation of the amendment, again drafted by the N.C. Constitutional Amendments Publication Commission. That explanation reads:

Cap Maximum State Income Tax at 7%

The current maximum personal and corporate income tax rate in our State Constitution is 10%. This proposed amendment makes the new limit 7%.

This proposed amendment does not reduce your current taxes. It does not change the current individual income tax rate of 5.499%, and it does not change the current corporate income tax rate of 3%. Instead, it limits how much the state income tax rate could go up.

This proposed amendment applies only to state income taxes. It does not affect sales taxes, property taxes, or federal taxes.

Income taxes are one of the ways State government raises the money to pay for core services such as public education, public health, and public safety.

The proposed amendment does not include any exceptions. Therefore, in times of disaster or recession, the State could have to take measures such as cutting core services, raising sales taxes or fees, or increasing borrowing.

After respondents were provided with the official explanation above, 45 percent were in favor of it, a decline of 11 percentage points from when the respondents were only provided simple ballot language. Of the remainder, 27 percent were against it and 28 percent said they did not know.

The segment of voters who said the official explanation gave them enough information to make an informed decision grew to 77 percent — an increase of 21 percentage points.

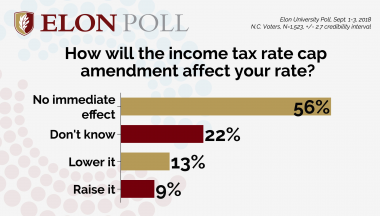

“We measured tax cap understanding using the best case, even if not most realistic, scenario- one in which voters had just read the official explanation of the amendment,” Husser said. “Still, over four out of 10 respondents could not correctly identify what immediate effect the amendment would have on their taxes.”

“We measured tax cap understanding using the best case, even if not most realistic, scenario- one in which voters had just read the official explanation of the amendment,” Husser said. “Still, over four out of 10 respondents could not correctly identify what immediate effect the amendment would have on their taxes.”

If passed, the amendment would not have any impact on the individual income tax rate, but would only come into play if that rate were increased in the future. Asked about how the amendment might impact their individual income tax rate, 9 percent of voters said it would increase their income tax rate, 13 percent said it would reduce the rate and 56 percent accurately responded that it would have no immediate effect. Another 22 percent said they did not know.

The Elon Poll found overall support for limiting the state’s ability to have free rein in increasing income tax revenue in emergencies, such as after a natural disaster or during a recession, versus having a cap on the tax rate. Seventy-one percent said that the state should make do with the income tax revenue it is legislatively allowed to generate and 29 percent said the state should be able to raise the income tax rate as much as needed.