Senior Seminar class write introductory guide to a tax incentive program aimed at promoting economic development in Elon’s community.

Five students in the class of 2019 produced a report, “Making the Most of Alamance County’s Opportunity Zones: A Primer.”

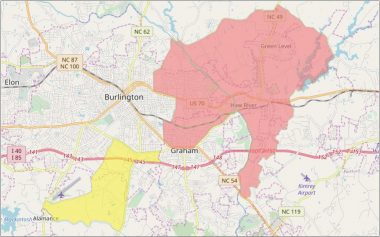

An Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. The regions were nominated by the state and approved by the U.S. Treasury Secretary. Alamance County contains four Census tracts designated as Qualified Opportunity Zones. The Opportunity Zone program encourages investment by allowing investors to defer capital gains tax and eliminate some taxes on some future earnings.

According to the report, “Ideally located in the Triad region of North Carolina, Alamance County has enormous potential for growth and development… The county is home to a strong community college and a nationally recognized university… With a number of vibrant communities surrounding Alamance County, over 14,000 people commute into Alamance County every day for jobs.”

The guide can be found at the following URL: https://drive.google.com/file/d/1z65LgeZhJ1-QyowX_zZOn5CH6fFKxUwB/view