The event, featuring speakers from Gitterman Wealth Management, Net Impact and The Redwoods Group, focused on using environmental, social and governance investing to help make positive social impact.

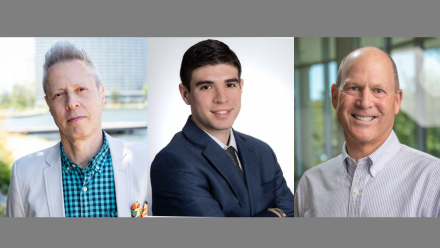

Peter Lupoff, CEO of Net Impact and GOOD Institute, Adam Bernstein ‘13, ESG/impact analyst at Gitterman Wealth Management, and Kevin Trapani, CEO of The Redwoods Group and Love School of Business executive-in-residence, offered insights into the growth of corporate social responsibility and environmental, social and governance (ESG) investing during a panel discussion hosted by Elon’s chapter of Net Impact.

Trapani opened the event by speaking about the purpose of businesses shifting from producing profits to now incorporating social responsibility.

“Businesses are the most powerful actors on the planet and the flow of capital to businesses is among the most powerful forces that we encounter in our society,” Trapani said.

Referencing BlackRock CEO Larry Fink’s 2018 letter to CEOs, Trapani explained businesses must show a positive contribution to society. “Investors today expect return and impact,” Trapani said.

Lupoff added, “We must continue to move in this direction of stakeholder capitalism, where employees, consumers, supply chain and the communities where companies operate are ratable with shareholders in terms of the objectives.”

When looking at sustainable investing, ESG metrics can show whether a company is behaving responsibly, plus, there is a high correlation between performing well on ESG metrics and performing well financially, Trapani shared.

“As a fiduciary investor myself, I use ESG datasets whenever I’m doing due diligence or making an investment decision because I think it is that relevant to risk and return rates,” said Bernstein, who graduated from Elon in 2013 with a degree in finance.

Lupoff shared that earlier in his career he realized investing in public securities using an ESG screen did not reduce his financial returns. Rather, he viewed doing so as capital markets nudges, helping to nudge businesses to be better.

“The dollars you put to work drive change,” he told the audience. “Through how we participate in capital markets, through investment, consumption, who we work with and why, we can hasten change in business.”

Sustainable investing is just one avenue of activism our generation can have to affect societal issues, Bernstein added.

Elon’s Net Impact chapter, advised by Associate Professor Christy Benson, encourages students to make positive sustainable and socially responsible impacts across the different disciplines in which they are engaged.

“As an organization, we believe there is a shared responsibility for creating a more sustainable and just world,” said chapter president and economic consulting major Katie Robinson ‘22. “We hosted this impact investing panel to learn how the power of money and personal investment can be harnessed to create positive social change. Hearing from our panelists helped me understand how investors can achieve both high social impact and high financial returns.”